Offer-in-Compromise

Facing IRS wage garnishments or levies? An Offer in Compromise (OIC) lets you settle for less. Alleviate Tax can help you qualify and navigate the process.

Monica V.

Owed $174,885 and was able to save over 100% despite her debt and interest (over $200K with penalties and interest).

Janet E.

Owed $1,200,000 and saved over 99.7% on her IRS period bill.

Sarah K.

Owed the IRS $588K and saved an astounding 99.8% of what she owed.

Looking for information about the Offer-in-Compromise?

Here’s an Overview

Click on the video below to learn more

As Seen & Heard On

Offer-in-Compromise

Facing IRS wage garnishments or levies? An Offer in Compromise (OIC) lets you settle for less. Alleviate Tax can help you qualify and navigate the process.

Click on the video below to learn more

As Seen & Heard On

How Tax Relief Works

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We'll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We'll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

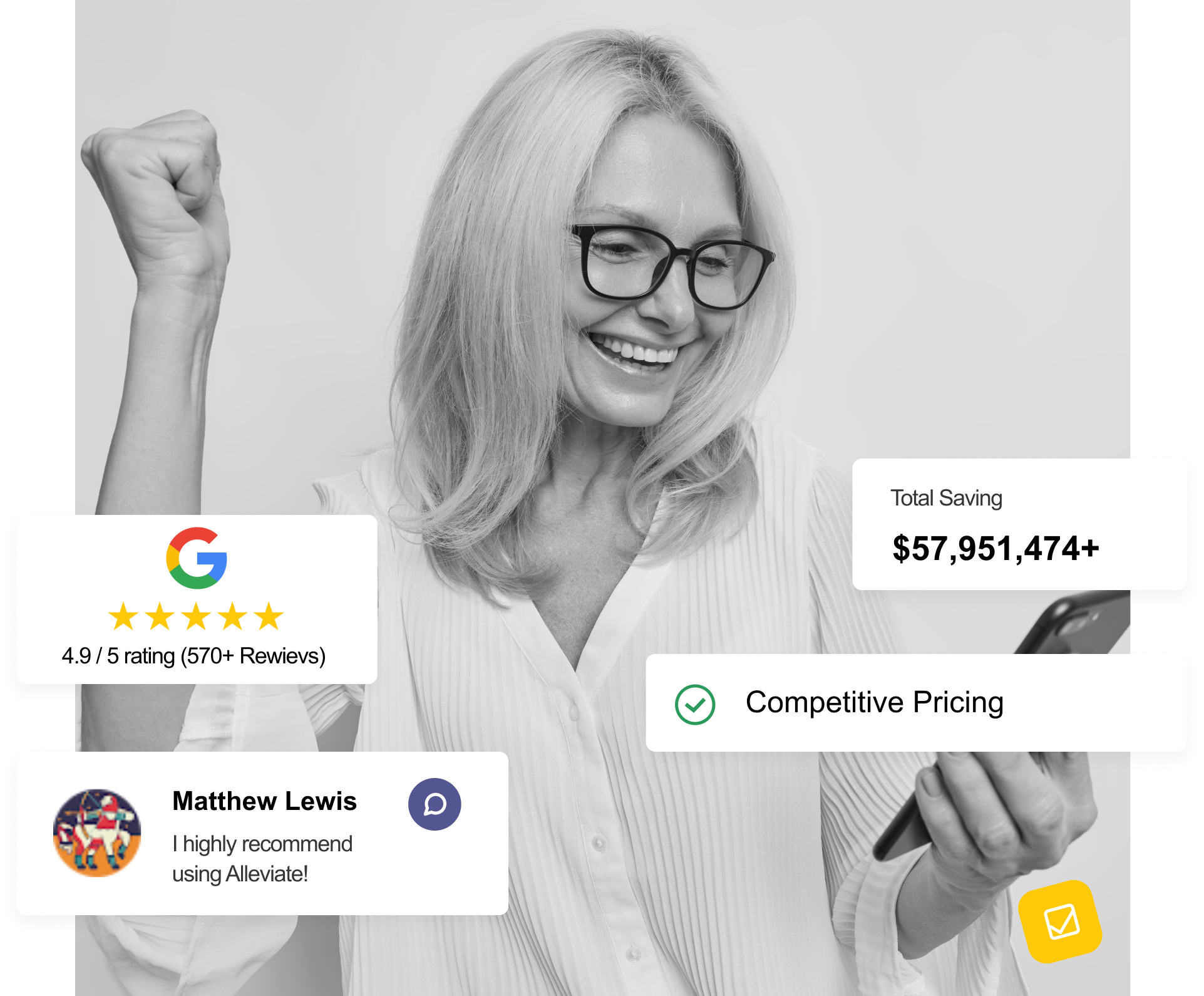

What People Say About Alleviate Tax

Alleviate Tax Reviews

Alleviate tax Relief service so far seems very knowledgeable and will explain tax programs in great detail they are still working on mine but I have good faith they will help me Kyle is very helpful and knowledgeable give them a try thanks again Alleviate Tax Relief

Lester Moore

I first went to another company to try and help me out with a situation I had and left me hanging without fixing the problem. The moment we entered in connection with Francisco, he has done nothing but make everything easy to understand, and shown nothing but great work and promised to help out till the end, highly recommend!!

Ramon Perez

Kyle H. Is very professional and understanding it’s been an amazing time working with Kyle. You’ll be happy to work with Kyle he really great at his job and helpful he very outstanding person to trust with you tax debt and time. THANK Kyle H. For all your hard work.

Vivian Harris

Owe Business or Personal back taxes? Alleviate Tax is Waiting to Speak to You!

Call Today For A Free Consultation

Get started with our team of tax professionals today, and get the tax relief your case deserves.

FAQ

What is an Offer in Compromise (OIC) and can it help me?

A tax professional can use this strategy to significantly reduce your debt if you qualify for extreme financial hardship.

Who qualifies for an IRS Offer in Compromise?

The Internal Revenue Service (IRS) takes into account multiple factors when assessing eligibility for an Offer in Compromise (OIC). Generally, you must demonstrate financial hardship and an inability to pay your tax debt in full through traditional methods like installment agreements. Recent Fresh Start Program updates make qualifying easier, excluding equity in certain assets (like ongoing businesses) from the calculation of repayment potential.

Isn't the IRS Offer in Compromise just another form of tax forgiveness?

While an OIC allows you to settle your debt for less, it’s not quite the same as tax forgiveness. The IRS will still consider factors like your ability to pay and the likelihood of collecting the full amount owed before accepting your offer.

How much should you offer in an Offer in Compromise?

There’s no one-size-fits-all answer to how much to offer in an OIC. The IRS considers your income, assets, and ability to pay when evaluating your offer. A qualified tax professional can analyze your situation and recommend a strategic offer amount that maximizes your chances of approval while minimizing the amount you pay. Alleviate Tax’s team of OIC specialists can guide you through this process.

What are the downsides of an Offer in Compromise?

There are a few things to consider with an OIC:

- Tax ramifications: The amount of forgiven debt might be deemed as taxable income by the IRS.

- Impact on credit score: An OIC can negatively impact your credit score for several years.

- Time commitment: The OIC process can take several months to complete.

Alleviate Tax can help you weigh the pros and cons of an OIC to determine if it’s the right option for you.

What are the benefits of using Alleviate Tax for my Offer in Compromise?

Alleviate Tax takes the complexity out of the OIC process. We’ll handle the calculations, navigate the qualification process, and keep you informed throughout each step. Our goal is to secure the most beneficial outcome for your tax situation, potentially saving you a substantial amount on your tax debt. In fact, we’ve helped clients save as much as 98% of their original tax debt through the OIC program!