Qualify For The IRS Fresh Start Program

The IRS Fresh Start program helps with tax issues related to wage garnishment or collection threats. If you owe over $10,000, Alleviate Tax can qualify you for this program. Our Certified Enrollment Agents can speak directly to the IRS for a quicker turnaround on your case. Don't face the IRS alone. Qualify today!

Monica V.

Owed $174,885 and was able to save over 100% despite her debt and interest (over $200K with penalties and interest).

Janet E.

Owed $1,200,000 and saved over 99.7% on her IRS period bill.

Sarah K.

Owed The IRS $588K and saved an astounding 99.8% of what she owed.

Looking for information about the IRS Fresh Start program?

Here’s an Overview

Click on the video below to learn more

As Seen & Heard On

Qualify For The IRS Fresh Start Program

The IRS Fresh Start program helps with tax issues related to wage garnishment or collection threats. If you owe over $10,000, Alleviate Tax can qualify you for this program. Our Certified Enrollment Agents can speak directly to the IRS for a quicker turnaround on your case. Don't face the IRS alone. Qualify today!

Click on the video below to learn more

As Seen & Heard On

How Tax Relief Works

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We’ll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

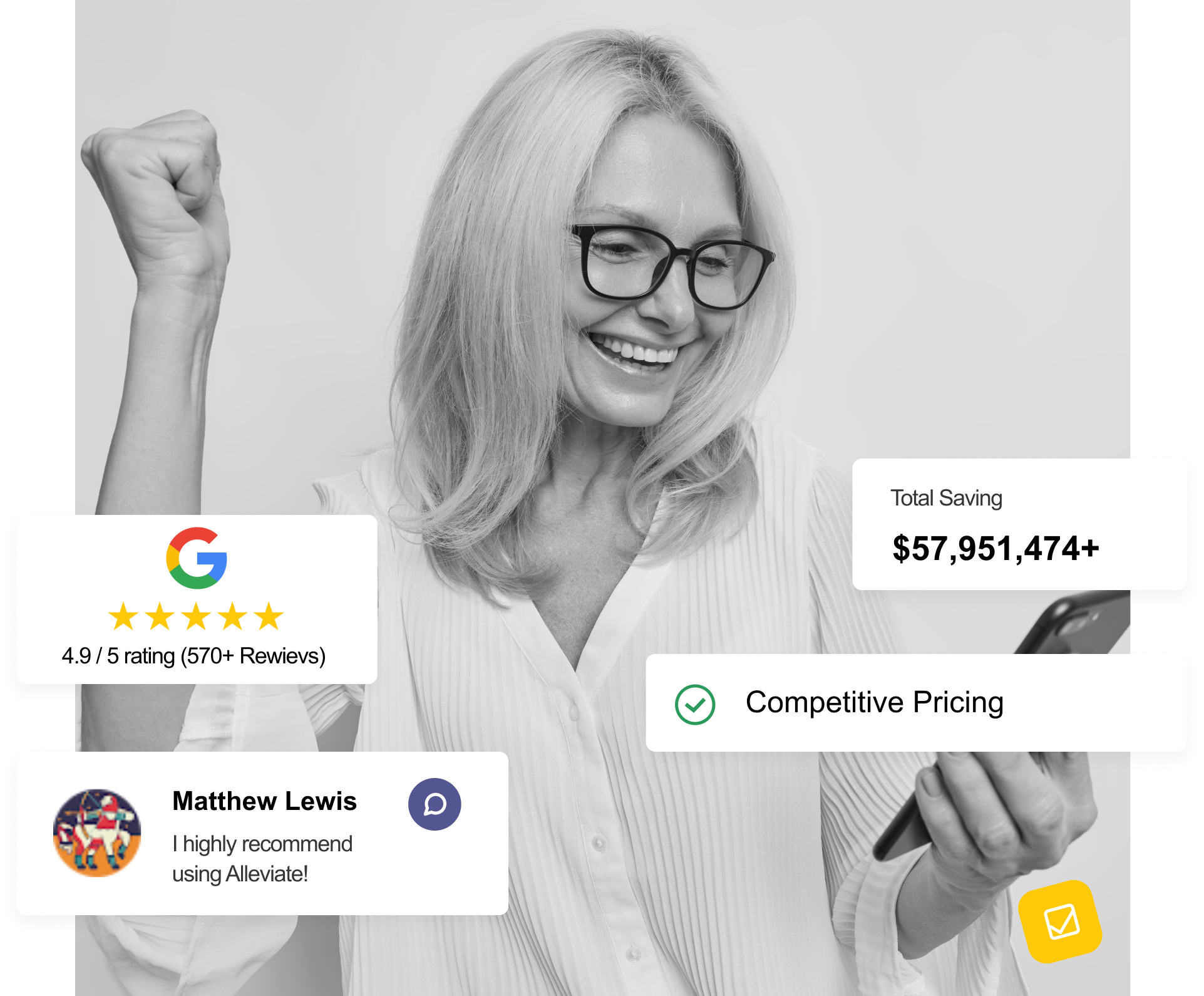

What People Say About Alleviate Tax

Tax Relief For The People We Love

What clients are saying…

Phil Sarro

At 75 YO I owe a little over $6,000 to the IRS when I was contacted by Gunnar about this he reviewed my infomation and then told me how to do it myself. Thank for sending me in the reght derection

Lester Moore

Alleviate tax Relief service so far seems very knowledgeable and will explain tax programs in great detail they are still working on mine but I have good faith they will help me Kyle is very helpful and knowledgeable give them a try thanks again Alleviate Tax Relief

Rosemary Borowski

My initial interaction with Alleviate has been with Joshua G. He was professional and considerate. He helped me understand what will happen and went through the document with me. I feel much more calm now that Joshua G has helped me.

Daniel Koehler

Ladan was fantastic and laid out my options very clearly, very knowledgeable and open about the fees. Any flat rate tax resolution firm like this is what you’re looking for. I will be referring my clients for their services as well.

Owe Business or Personal back taxes? Alleviate Tax is Waiting to Speak to You!

Call Today For A Free Consultation

Get started with our team of tax professionals today, and get the tax relief your case deserves.

FAQ

What is the IRS Fresh Start Program and can it help me?

While the IRS doesn’t offer a single program called “Fresh Start,” the term is often used to describe a collection of initiatives aimed at helping taxpayers resolve outstanding tax debt. These initiatives can be a lifesaver if you’re facing wage garnishments, bank levies, or other serious consequences from the IRS.

Who qualifies for the IRS Fresh Start program?

While there isn’t a single “Fresh Start” program, the IRS offers options for taxpayers facing tax debt. These options typically target individuals with manageable tax burdens (under $50,000) and demonstrable financial hardship. Being current on filing all tax returns is usually a requirement.

What are some of the benefits of the IRS Fresh Start Program?

The Fresh Start initiatives offer various benefits, including:

- Reduced Penalties and Interest: The IRS may be willing to lower penalties and accruing interest on your tax debt.

- Streamlined Installment Agreements: You can set up manageable monthly payments to pay off your tax debt over time.

- Offer in Compromise: In some cases, the IRS might allow you to settle your debt for less than the total amount owed.

What if the IRS Fresh Start Program isn't a good fit for me?

If your tax debt exceeds the Fresh Start program’s limitations, Alleviate Tax can still help! We offer a variety of tax relief services, including:

- Negotiating with the IRS on your behalf

- Exploring other IRS debt resolution options

- Ensuring you’re compliant with future tax filings

Does the IRS still offer the Fresh Start program?

The term “Fresh Start” isn’t an official program name anymore. However, the IRS still offers various initiatives to help taxpayers resolve tax debt. These include streamlined installment plans, penalty reduction, and even settling your debt for less than owed (Offer in Compromise).

Is IRS Fresh Start legitimate?

Yes, the initiatives referred to as “Fresh Start” are legitimate IRS programs. However, be cautious of scams promising effortless tax debt forgiveness. If you’re unsure about your eligibility or the legitimacy of an offer, Alleviate Tax can help you navigate the IRS options and ensure you’re working with a reputable professional.