Installment Agreements

Alleviate Tax facilitates manageable payment plans for individuals, often reducing interest and penalties, easing the challenge of paying off tax debt, especially when contacting the IRS directly can be time-consuming and frustrating.

Monica V.

Owed $174,885 and was able to save over 100% despite her debt and interest (over $200K with penalties and interest).

Janet E.

Owed $1,200,000 and saved over 99.7% on her IRS period bill.

Sarah K.

Owed the IRS $588k and saved an astounding 99.8% of what she owed.

Looking for information about the Installment Agreements?

Here’s an Overview

Click on the video below to learn more

As Seen & Heard On

Installment Agreements

Alleviate Tax facilitates manageable payment plans for individuals, often reducing interest and penalties, easing the challenge of paying off tax debt, especially when contacting the IRS directly can be time-consuming and frustrating.

Click on the video below to learn more

As Seen & Heard On

How Tax Relief Works

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We’ll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

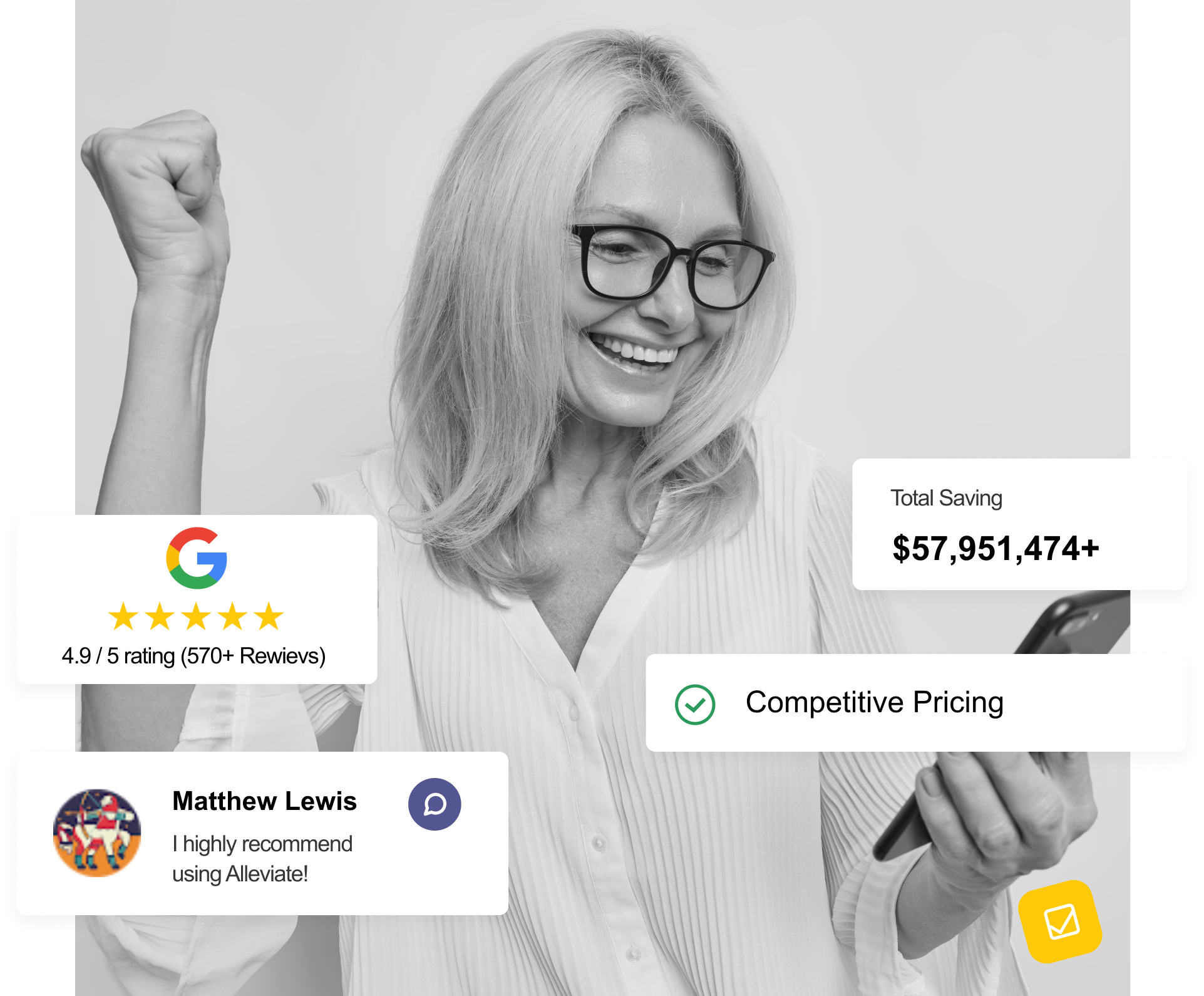

What People Say About Alleviate Tax

Alleviate Tax Reviews

Joshua Gordon was very good in helping me with my situation he explained everything step by step he was very understanding and patient with me very nice guy

Brenda Mcmurray

Very professional! Excited to get this process behind me. First times in years, I felt listened to and understood regarding my health hardship that caused this problem. I like solutions!! Thank you Whitney!!!

Amber Sherman

I talked to Gabriel and he helped me figure out what was going on with my tax situation. I thought I had a balance with the IRS, but I wasn't sure how much it was. He was kind enough to direct me on where to look because he didn't want me to have to pay for any services if there wasn't a balance present.

Jeremiah Lewis

Owe Business or Personal back taxes? Alleviate Tax is Waiting to Speak to You!

Call Today For A Free Consultation

Get started with our team of tax professionals today, and get the tax relief your case deserves.

FAQ

What is an Installment Plan Agreement?

An installment plan agreement, also known as an IRS installment agreement, is a formal agreement between you and the IRS that allows you to repay your tax debt in manageable monthly installments over a set period. This can be a lifesaver if you can’t afford to pay your tax debt in full upfront.

Here are some key points to remember:

- Spreads Out Payments: Installment plans break down your tax debt into smaller, more manageable chunks, easing the financial burden.

- Reduces Stress: Knowing you have a plan in place can significantly reduce the anxiety associated with tax debt.

- Prevents harsher actions: An installment agreement prevents the IRS from taking harsher actions like wage garnishments or bank levies.

If you’re struggling with tax debt, an IRS installment agreement could be the solution you need. Alleviate Tax can help you establish a plan and navigate the process!

Is an IRS Installment Agreement Worth It?

An IRS installment agreement can be highly beneficial for several reasons:

- Manageable Payments: You can tailor the payment plan to fit your budget, ensuring you can comfortably afford the monthly installments.

- Avoids Penalties and Interest Growth: While some interest and penalties may still apply, an installment plan can help prevent them from accruing further, potentially saving you money in the long run.

- Protects Your Assets: An installment agreement protects your assets from potential IRS seizure, such as your car or home.

While there may be upfront fees associated with setting up an installment agreement, the benefits often outweigh the costs. Alleviate Tax can help you determine if an installment agreement is the right choice for your situation.

Can the IRS Deny an Installment Agreement?

Yes, the IRS can deny your request for an installment agreement under certain circumstances. However, they typically consider several factors before making a decision:

- Debt Amount: Generally, the IRS is more likely to approve installment agreements for smaller tax debts.

- Filing History: A history of timely tax filings and payments can strengthen your case for an agreement.

- Financial Situation: The IRS will assess your ability to repay the debt based on your income and expenses.

If your initial request is denied, Alleviate Tax can help you understand the reasons and explore alternative options for resolving your tax debt.

How Many Installment Agreements Can I Have with the IRS?

There is no set limit on the number of installment agreements you can have with the IRS. However, you typically cannot have multiple active agreements for the same tax type (e.g., income tax) at the same time.

Here are some scenarios where you might need a new installment agreement:

- Previous Agreement Paid Off: Once you’ve completed a previous agreement, you can apply for a new one for a new tax debt.

- Changed Financial Circumstances: If your financial situation has changed significantly since your initial agreement, you may be able to renegotiate a new plan with lower payments.

Alleviate Tax can help you navigate the process of applying for a new installment agreement or modifying an existing one.

Can the IRS Deny an Installment Agreement?

Yes, the IRS can deny your request for an installment agreement under certain circumstances. However, they typically consider several factors before making a decision:

- Debt Amount: Generally, the IRS is more likely to approve installment agreements for smaller tax debts.

- Filing History: A history of timely tax filings and payments can strengthen your case for an agreement.

- Financial Situation: The IRS will assess your ability to repay the debt based on your income and expenses.

If your initial request is denied, Alleviate Tax can help you understand the reasons and explore alternative options for resolving your tax debt.

What Happens if You Owe More Than $50,000 to the IRS?

If your tax debt exceeds $50,000, you may still qualify for an IRS installment agreement, although the terms might differ slightly. Alleviate Tax can navigate these situations and help you secure a manageable payment plan, even with a larger tax burden.

In addition to installment agreements, Alleviate Tax can explore other IRS debt relief options, such as:

- Short-Term Payment Plans: For smaller tax debts, a shorter payment term might be available.

- IRS Forgiveness Programs: The IRS offers programs for taxpayers facing financial hardship. We can assess your eligibility for these programs.

No matter your tax debt amount, Alleviate Tax can help you find a solution!