Penalty Abatement

For overdue taxes and unfiled returns, Alleviate Tax can eliminate penalties and interest through abatement.

Monica V.

Owed $174,885 and was able to save over 100% despite her debt and interest (over $200K with penalties and interest).

Janet E.

Owed $1,200,000 and saved over 99.7% on her IRS period bill.

Sarah K.

Owed the IRS $588K and saved an astounding 99.8% of what she owed.

Looking for information about the Penalty Abatement?

Here’s an Overview

Click on the video below to learn more

As Seen & Heard On

Penalty Abatement

For overdue taxes and unfiled returns, Alleviate Tax can eliminate penalties and interest through abatement.

Click on the video below to learn more

As Seen & Heard On

How Tax Relief Works

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We’ll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

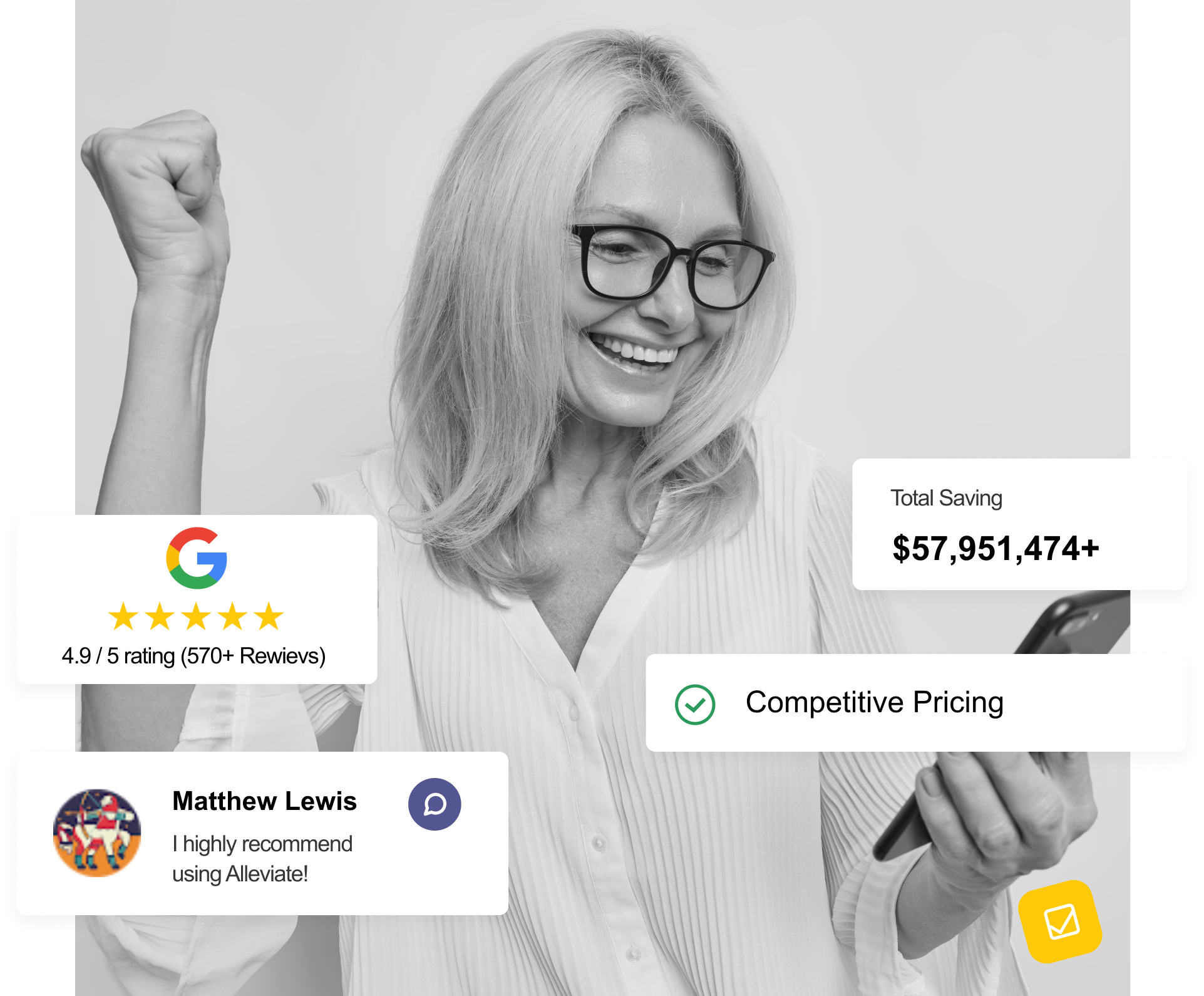

What People Say About Alleviate Tax

Alleviate Tax Reviews

Phil Sarro

At 75 YO I owe a little over $6,000 to the IRS when I was contacted by Gunnar about this he reviewed my infomation and then told me how to do it myself. Thank for sending me in the reght derection

Lester Moore

Alleviate Tax Relief Service so far seems very knowledgeable and will explain tax programs in great detail they are still working on mine but I have good faith they will help me Kyle is very helpful and knowledgeable give them a try thanks again Alleviate Tax Relief

Rosemary Borowski

My initial interaction with Alleviate has been with Joshua G. He was professional and considerate. He helped me understand what will happen and went through the document with me. I feel much more calm now that Joshua G has helped me.

Daniel Koehler

Ladan was fantastic and laid out my options very clearly, very knowledgeable and open about the fees. Any flat rate tax resolution firm like this is what you’re looking for. I will be referring my clients for their services as well.

Owe Business or Personal back taxes? Alleviate Tax is Waiting to Speak to You!

Call Today For A Free Consultation

Get started with our team of tax professionals today, and get the tax relief your case deserves.

FAQ

What is First-Time Penalty Abatement and can it help me?

If you’re facing tax penalties for the first time, the IRS’s First-Time Penalty Abatement (FTPA) waiver might be your solution. This program offers a chance to have these penalties removed if you meet certain criteria. Alleviate Tax can help you navigate the process and potentially save you thousands in penalties and interest.

Who qualifies for First-Time Penalty Abatement?

The First-Time Penalty Abatement waiver is available to both individuals and businesses who have incurred penalties for failing to file, pay, or deposit taxes for the first time. It’s crucial to have a good compliance history with the IRS before this penalty. Additionally, the First-Time Penalty Abatement only applies to a single tax year, so you may need to explore other options for penalties from previous years.

How do I request a penalty abatement from the IRS?

There are two main ways to request a penalty abatement from the IRS:

- By phone: If you qualify for the First-Time Penalty Abatement (FTPA) waiver, you might be able to request it over the phone by calling the number listed on your IRS notice.

- By mail: You can submit a written request using Form 843, Claim for Refund and Request for Abatement. Include a detailed explanation of why you believe your penalties should be removed.

Having trouble navigating the process? Alleviate Tax can help! We’ll assess your situation and guide you through the most effective method for requesting penalty abatement.

Can I get the IRS to waive penalties and interest?

Yes, the IRS has programs in place to waive penalties and interest on your tax debt. Here are two possibilities:

- First-Time Penalty Abatement (FTPA): This program allows the IRS to waive penalties for first-time offenders who meet specific criteria.

- Reasonable Cause Abatement: If you can demonstrate a legitimate reason for missing deadlines or filing errors (e.g., serious illness, or natural disaster), the IRS might waive your penalties and interest under “reasonable cause” guidelines.

Confused about which program applies to you? Alleviate Tax can analyze your situation and determine the best path towards penalty and interest abatement.

What is a good reasonable cause for IRS penalty abatement?

The IRS assesses several elements when determining ‘reasonable cause’ for penalty relief. Some acceptable reasons include:

- Serious illness, hospitalization, or accident

- Death of a family member

- Natural disaster

- Incorrect information from the IRS

- Military service

Not sure if your situation qualifies? Alleviate Tax can help! We’ll review your circumstances and craft a compelling explanation for your request for penalty abatement.

I'm overwhelmed by the IRS penalty process. Can Alleviate Tax help?

Absolutely! Tax penalty rules and calculations can be complex. Alleviate Tax’s team of penalty abatement specialists can handle the entire process for you. We’ll determine your eligibility for the FTPA or other programs, ensuring you get the best possible outcome.