Tax Resolution Assistance

Alleviate Tax offers professional assistance in resolving IRS issues, potentially reducing your total tax debt, including penalties and interest, providing a more favorable outcome compared to direct contact with the IRS.

Monica V.

Owed $174,885 and was able to save over 100% despite her debt and interest (over $200K with penalties and interest).

Janet E.

Owed $1,200,000 and saved over 99.7% on her IRS period bill.

Sarah K.

Owed the IRS $588K and saved an astounding 99.8% of what she owed.

Looking for information about the Tax Resolution Assistance?

Here’s an Overview

Click on the video below to learn more

As Seen & Heard On

Tax Resolution Assistance

Alleviate Tax offers professional assistance in resolving IRS issues, potentially reducing your total tax debt, including penalties and interest, providing a more favorable outcome compared to direct contact with the IRS.

Click on the video below to learn more

As Seen & Heard On

How Tax Relief Works

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We'll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We'll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

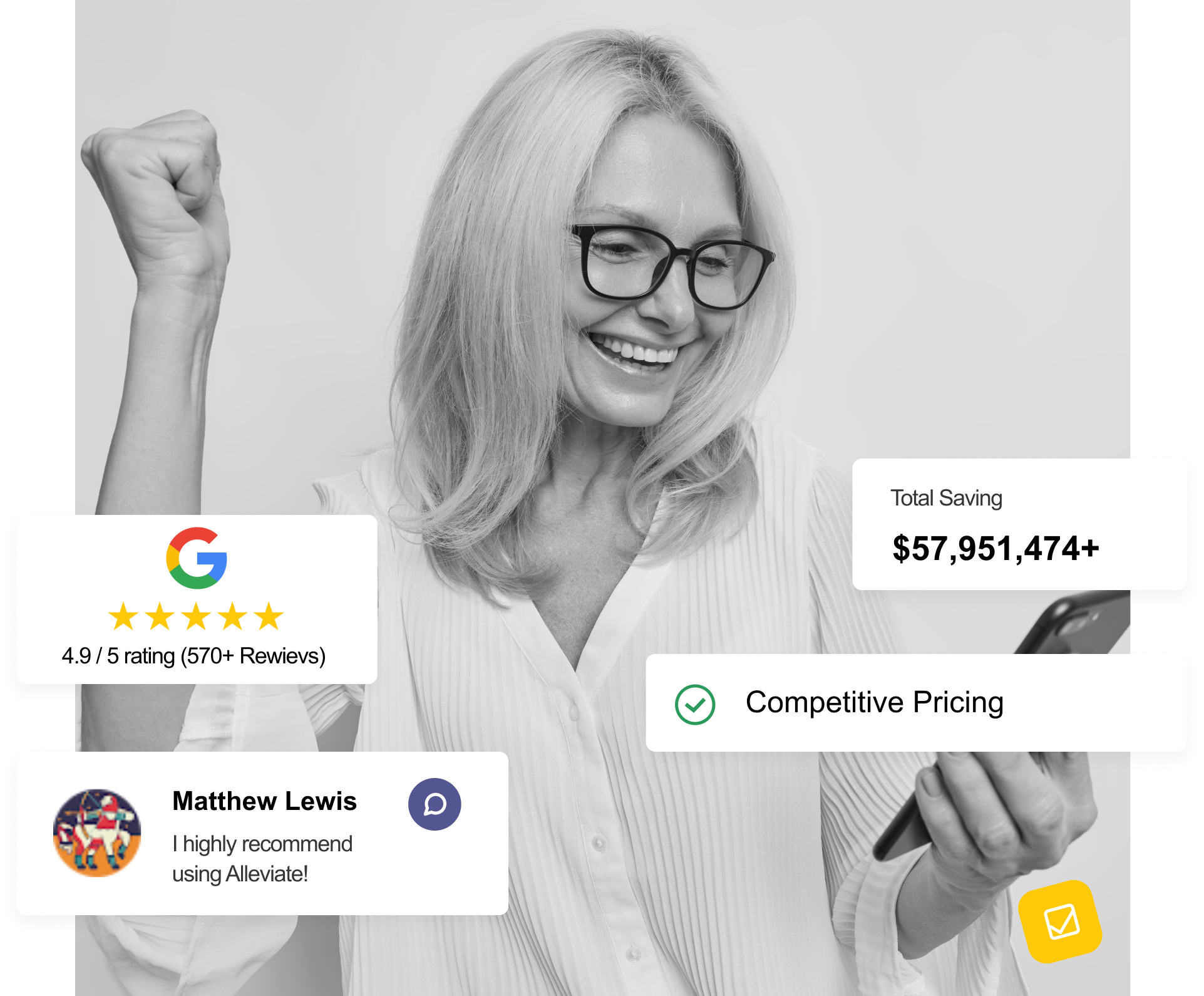

What People Say About Alleviate Tax

Alleviate Tax Reviews

Wow, Whitney really helped me out. I didn’t think I had any hope of how to resolve my issue with the IRS. I’m happy that I answered the phone. Thanks Whitney😉

Bertola Seltzer

Just wanna thank kyle f. for helping elevate my tax debt. It was easy...He is professional and informative...feel like a huge load of anxiety and fear has been taken off my shoulders. And this service is truly affordable...thanks again..

Shane Jacobs

Joshua Gordon was very helpful in assisting me with my application for tax relief. He explained each page that I was required to sign which made me feel comfortable and trusting in his knowledge of his company and the services they provide.

Carolyn Contreras-Guzman

Owe Business or Personal back taxes? Alleviate Tax is Waiting to Speak to You!

Call Today For A Free Consultation

Get started with our team of tax professionals today, and get the tax relief your case deserves.

FAQ

Are Tax Resolution Companies Legit and Can They Help?

Absolutely! Alleviate Tax is a team of experienced tax professionals specializing in IRS tax resolution. We understand the complexities of tax law and can navigate the system effectively. We can potentially:

- Reduce your tax debt: We explore options to lower your overall tax burden, including penalties, interest, and fees.

- Negotiate a payment plan: We can work with the IRS to establish a manageable monthly payment plan that fits your budget.

- Explore tax relief programs: The IRS offers various programs for struggling taxpayers. We can determine if you qualify for options like hardship relief or an Offer in Compromise.

Don’t let doubt hold you back. Alleviate Tax can be your advocate and fight for a favorable outcome!

When Should I Contact a Tax Advocate vs. Handling It Myself?

While you have the right to deal directly with the IRS, navigating their complex procedures can be challenging. Here’s why Alleviate Tax can be a valuable asset:

- Expertise: We possess in-depth knowledge of tax laws and procedures, ensuring you take the most strategic approach.

- Negotiation Skills: We are skilled negotiators who can advocate for your best interests with the IRS.

- Time-Saving Efficiency: We handle the communication and paperwork, freeing you to focus on your financial well-being.

Don’t waste time struggling alone. Alleviate Tax can streamline the process and potentially save you money.

What is the Tax Resolution Process and How Can Alleviate Tax Help?

The tax resolution process can be intricate, involving steps like:

- Debt analysis: We meticulously assess your tax situation to determine the best course of action.

- Communication with the IRS: We handle all communication with the IRS on your behalf, ensuring accuracy and clarity.

- Negotiation and representation: We advocate for your rights and negotiate a favorable resolution with the IRS.

Alleviate Tax simplifies the process and guides you every step of the way.

Can I Get My IRS Debt Forgiven Through Hardship or Other Programs?

Yes, there are options for tax debt forgiveness! The IRS offers programs like:

- IRS Hardship Refund Request: If you’re facing financial hardship, you may qualify for a refund of previously paid taxes.

- Offer in Compromise: This program allows you to settle your tax debt for a lump sum payment significantly lower than the total owed.

Alleviate Tax can assess your eligibility for these programs and guide you through the application process.

Can I Negotiate with the IRS Myself?

Yes, you can negotiate with the IRS yourself. However, it’s important to consider the potential benefits of having a tax professional on your side:

- Understanding the Process: Tax laws and procedures can be complex. Alleviate Tax can ensure you approach negotiations strategically, knowing what arguments and documentation are most likely to be successful.

- Effective Communication: We know how to communicate effectively with the IRS to improve your chances of a successful outcome. We can present your case clearly, concisely, and professionally.

- Negotiation Expertise: Our skilled negotiators have extensive experience dealing with the IRS. We understand their negotiation tactics and can fight for the best possible outcome on your behalf.

While you have the legal right to represent yourself, Alleviate Tax can significantly increase your chances of achieving a favorable resolution with the IRS.

Here are some additional considerations:

- Time Commitment: Negotiating with the IRS can be time-consuming, requiring phone calls, paperwork, and potentially in-person meetings. Alleviate Tax can handle all of this for you, freeing up your time.

- Stress Reduction: Facing the IRS can be stressful. Alleviate Tax can take the burden off your shoulders and give you peace of mind.

Don’t hesitate to take control of your tax situation. Contact Alleviate Tax today for a free consultation and see how we can help you navigate the IRS and achieve a brighter financial future!

Looking for Help with IRS Tax Problems? Alleviate Tax is Here!

Don’t let IRS problems control your life. Alleviate Tax offers comprehensive assistance, including:

- Tax penalty abatement: We can challenge penalties you believe are unfair or inaccurate.

- Tax lien removal: We may be able to help get a lien placed on your assets removed.

- Wage garnishment stop: We can work towards stopping the IRS from garnishing your wages.

Alleviate Tax is your partner in navigating IRS issues. Contact us today for a free consultation and a brighter financial future!