Wage Garnishment Removal

The IRS can take up to 70% of your income for back taxes. Alleviate Tax helps you regain control with an approved installment plan.

Monica V.

Owed $174,885 and was able to save over 100% despite her debt and interest (over $200K with penalties and interest).

Janet E.

Owed $1,200,000 and saved over 99.7% on her IRS period bill.

Sarah K.

Owed the IRS $588k and saved an astounding 99.8% of what she owed.

Looking for information about the Wage Garnishment Removal?

Here’s an Overview

Click on the video below to learn more

As Seen & Heard On

Wage Garnishment Removal

The IRS can take up to 70% of your income for back taxes. Alleviate Tax helps you regain control with an approved installment plan.

Click on the video below to learn more

As Seen & Heard On

How Tax Relief Works

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We'll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

Get Started With A Free Consultation

Speak with one of our tax professionals who can guide you through our process.

Phase 1: Investigation (~7 Days)

A dedicated tax professional investigates your status with the IRS or State, then presents you with a detailed report and analysis of your tax status with the IRS or State. We'll present options and suggest a plan to resolve your tax debt.

Phase 2: Active Resolution (3-9 Months)

Depending upon which programs you qualify for, we partner with you to get your taxes in compliance and achieve the lowest possible resolution for you.

Resolution

You’re back to compliance for the IRS, your state’s franchise tax board, or both! You’re tax debt is resolved.

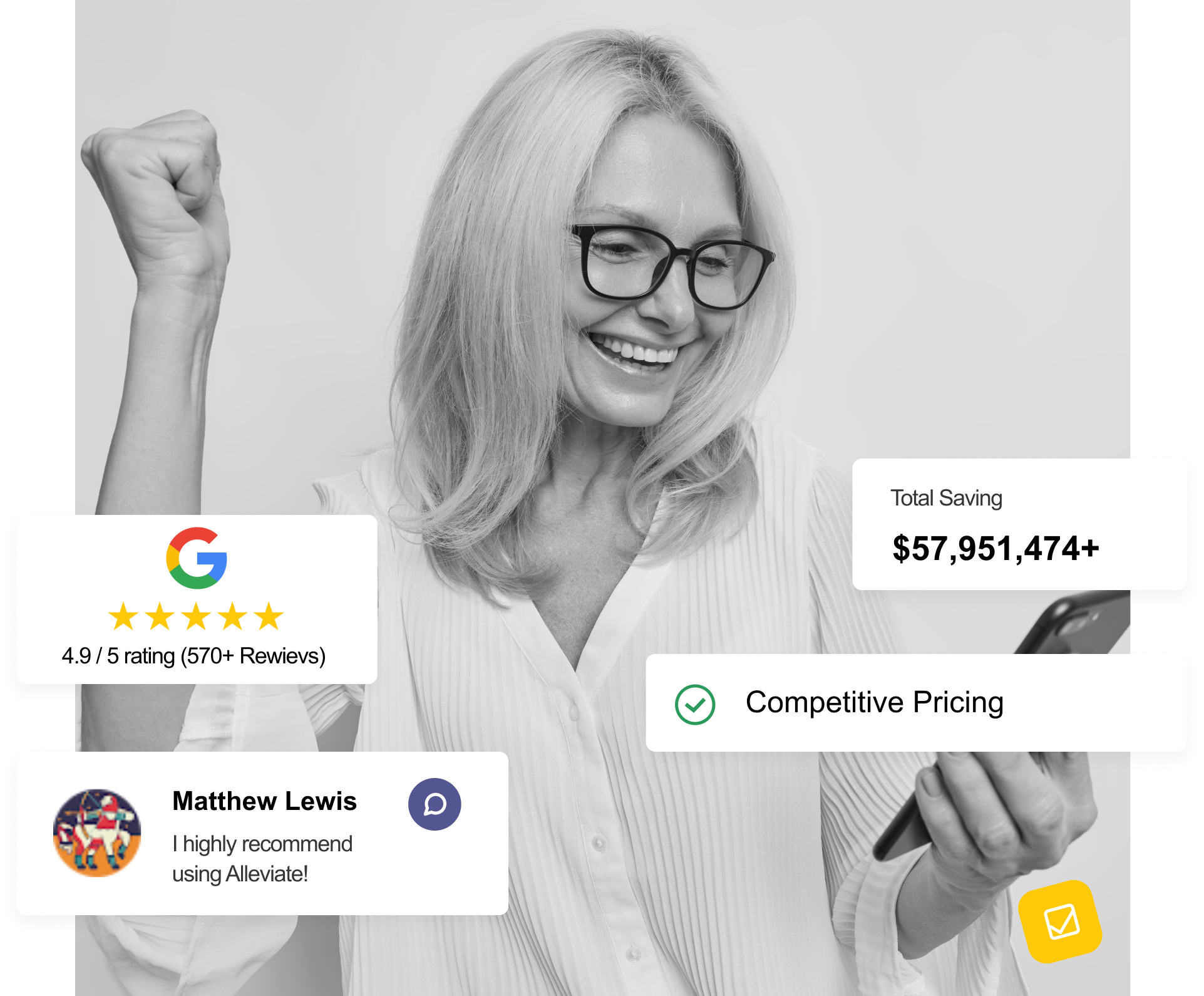

What People Say About Alleviate Tax

Alleviate Tax Reviews

Arsalan was amazing throughout the entire process. I have been stuck dealing with these tax issues for years. Arsalan showed me there was a light at the end of the tunnel. It took a couple of years, but they were able to finally get me out of this mess once and for all. If you have any doubts, just ask for Arsalan.

Corissa Waite

My experience was very rewarding Melvin C. explained everything really well. He was very thorough and professional. He gave me hope. I would highly recommend Alleviate Tax Relief Service for any one with tax related concerns.

Karen Murphy

Certainly will recommend to everyone. Brandon was so helpful and thorough, and gave me back my peace of mind, knowing I'm never alone through this difficult time. Will tell all owner operators im in contact with

David Crawhorn

Owe Business or Personal back taxes? Alleviate Tax is Waiting to Speak to You!

Call Today For A Free Consultation

Get started with our team of tax professionals today, and get the tax relief your case deserves.

FAQ

The IRS is garnishing my wages! How can I stop it immediately?

Wage garnishments can be a significant financial burden. If the IRS is taking a chunk of your paycheck, Alleviate Tax can help! We specialize in navigating IRS procedures and can explore options to stop wage garnishment as quickly as possible. This may involve:

- Negotiating an installment plan: We can work with the IRS to establish a manageable payment plan that allows you to keep more of your paycheck.

- Applying for hardship relief: If you’re facing financial hardship, we can help you explore programs that might pause or reduce your wage garnishment.

- Filing for an Offer in Compromise (OIC): In some cases, an OIC allows you to settle your tax debt with the IRS for less than the full amount owed, potentially stopping wage garnishment altogether.

Can you stop a garnishment once it starts?

Yes, there are ways to stop a wage garnishment even after it’s begun. Alleviate Tax can help you explore options like:

- Negotiating a payment plan: An installment plan allows you to pay your tax debt over time, potentially prompting the IRS to halt the garnishment.

- Demonstrating financial hardship: If you can prove significant financial hardship, the IRS might temporarily suspend the garnishment.

- Filing for an appeal: In certain situations, you may be able to appeal the garnishment with the IRS.

While stopping a garnishment is possible, it’s crucial to act quickly. Alleviate Tax can guide you through the process and increase your chances of success.

How do I write a letter to stop wage garnishment?

Writing a compelling letter to the IRS requesting a halt to wage garnishment can be complex. Alleviate Tax can help you craft a professional and persuasive letter that outlines your situation and highlights your reasons for needing relief. We’ll ensure your request includes all the necessary details to be taken seriously by the IRS.

Don’t navigate this process alone. Let Alleviate Tax’s experienced professionals handle the communication with the IRS for you.

Can debt consolidation stop wage garnishment?

Debt consolidation itself won’t stop wage garnishment from the IRS. However, consolidating your debt into a single loan payment might free up some income you can use towards a higher monthly payment to the IRS. This could potentially lead them to halt the garnishment.

It’s important to remember that debt consolidation is a complex financial decision. Alleviate Tax can help you evaluate your options and determine if consolidation is the right strategy for your situation.

Can you negotiate a wage garnishment?

Yes, negotiating a payment plan with the IRS is a viable option to potentially stop wage garnishment. Alleviate Tax’s skilled negotiators can work with the IRS on your behalf to establish a manageable monthly payment that allows you to keep more of your paycheck. We’ll fight to ensure the terms are fair and in your best interest.

Don’t feel pressured to accept the first offer from the IRS. Alleviate Tax can be your advocate and ensure you get the best possible outcome.

Keywords: stop wage garnishment, negotiate a wage garnishment, Alleviate Tax stop wage garnishment

In addition to stopping wage garnishment, Alleviate Tax can explore other tax relief options to minimize your overall tax burden. These may include:

- Penalty abatement: We can help you request the IRS to waive penalties and interest associated with your tax debt.

- Fresh Start programs: The IRS offers various programs to help taxpayers facing tax debt. We can determine if you qualify for any Fresh Start initiatives that could provide relief.

- Offer in Compromise (OIC): An OIC allows you to settle your tax debt with the IRS for less than the full amount owed.

Contact Alleviate Tax today for a free consultation and get the help you deserve!

What are the benefits of working with Alleviate Tax to stop wage garnishment?

Alleviate Tax takes the stress out of dealing with the IRS. Here’s how we can help:

- Stop wage garnishment quickly: We prioritize getting the IRS to stop taking money from your paycheck as soon as possible.

- Save you money: We explore all avenues for tax relief, potentially saving you tens of thousands of dollars on your tax debt.

- Reduce stress and anxiety: Our team handles the complicated tax issues, allowing you to focus on your financial well-being.

Don’t let wage garnishment hold you back. Contact Alleviate Tax today for a free consultation and get the help you deserve!